Daniel J. Brown, CPA

Tax Preparer near Elmhurst, Hinsdale, Lombard, Oak Brook, Villa Park

Tax Preparation

"Tax preparation is more than putting

numbers on tax forms. Understanding clients' needs and

circumstances and advising them is central to preparing their

tax returns."

As a result of the Tax Cuts and Jobs Act of 2017, many tax saving strategies have changed.

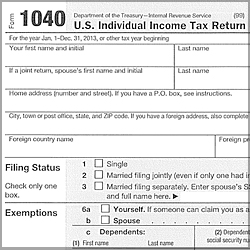

Individuals All

matters affecting the tax return are

considered. We may consider whether filing separately may be more advantageous than filing jointly or whether one qualifies to file as head of household rather than single or married filing separately. In addition, we look at dependents. Many times parents are overlooked as dependents or as medical dependents; we also look for circumstances where parents could save income tax by not claiming their children as dependents. Note, when parents do not claim their children as dependents, the children on their returns may need to indicate they could be taken as a dependent on another person's tax return.

Individuals All

matters affecting the tax return are

considered. We may consider whether filing separately may be more advantageous than filing jointly or whether one qualifies to file as head of household rather than single or married filing separately. In addition, we look at dependents. Many times parents are overlooked as dependents or as medical dependents; we also look for circumstances where parents could save income tax by not claiming their children as dependents. Note, when parents do not claim their children as dependents, the children on their returns may need to indicate they could be taken as a dependent on another person's tax return.

Special rules affect the taxation of persons in some occupations, such as

commodity trader, day trader, and minister. In addition, we want to look for legitimate means to increase QBI since only 80 percent of this income is taxable. We also consider whether clients have planning opportunities for college or retirement saving, for divorce and separation, for being unemployed, and for withdrawing money from retirement

accounts. If so, we advise clients accordingly.

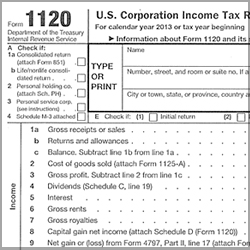

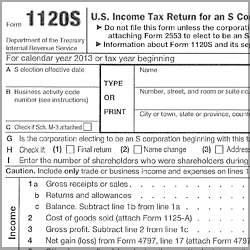

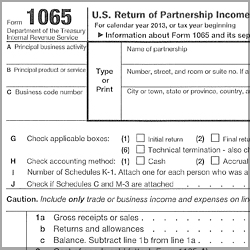

Businesses Corporations, partnerships,

LLC's, and sole proprietorships have different tax

characteristics; with clients who are considering

starting a company or who have recently started

one, we discuss these differences and highlight planning

opportunities. We then review the business's accounting process

and whether the company is compliant with payroll,

sales tax, and income tax requirements. If necessary,

we prepare financial statements.

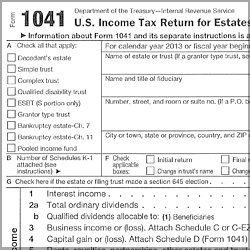

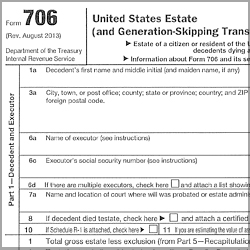

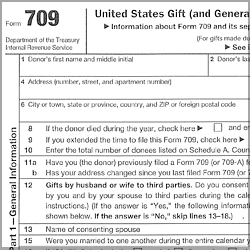

Trusts & Estates We prepare estate

tax returns (form 706) and estate and trust income tax

returns (form 1041). The discussion touches

on provisions of the will or trust, how the tax is

calculated, and tax saving opportunities. As

an example, in some cases trust and estate income

tax returns can be combined in a single return,

resulting in significant tax and administrative

savings.

Trusts & Estates We prepare estate

tax returns (form 706) and estate and trust income tax

returns (form 1041). The discussion touches

on provisions of the will or trust, how the tax is

calculated, and tax saving opportunities. As

an example, in some cases trust and estate income

tax returns can be combined in a single return,

resulting in significant tax and administrative

savings.

Of course, clients have many

questions about various issues, and these

concerns are discussed.

Clients Outside Chicago Area

Many send their documents to us, and we provide them the same

high-quality service that our local clients enjoy. Some clients schedule phone

consultations or call to discuss specific

matters.

In the past, source documents were rarely sent by email due

to security concerns. Now, with portal technology,

documents can be safely sent electronically.

1 Mile West of Oakbrook Shopping Center

1S443 Summit Avenue

Oak Brook Terrace, Illinois 60181

630 629-4400

630 568-3997 fax

Email: info@djbrowncpa.com